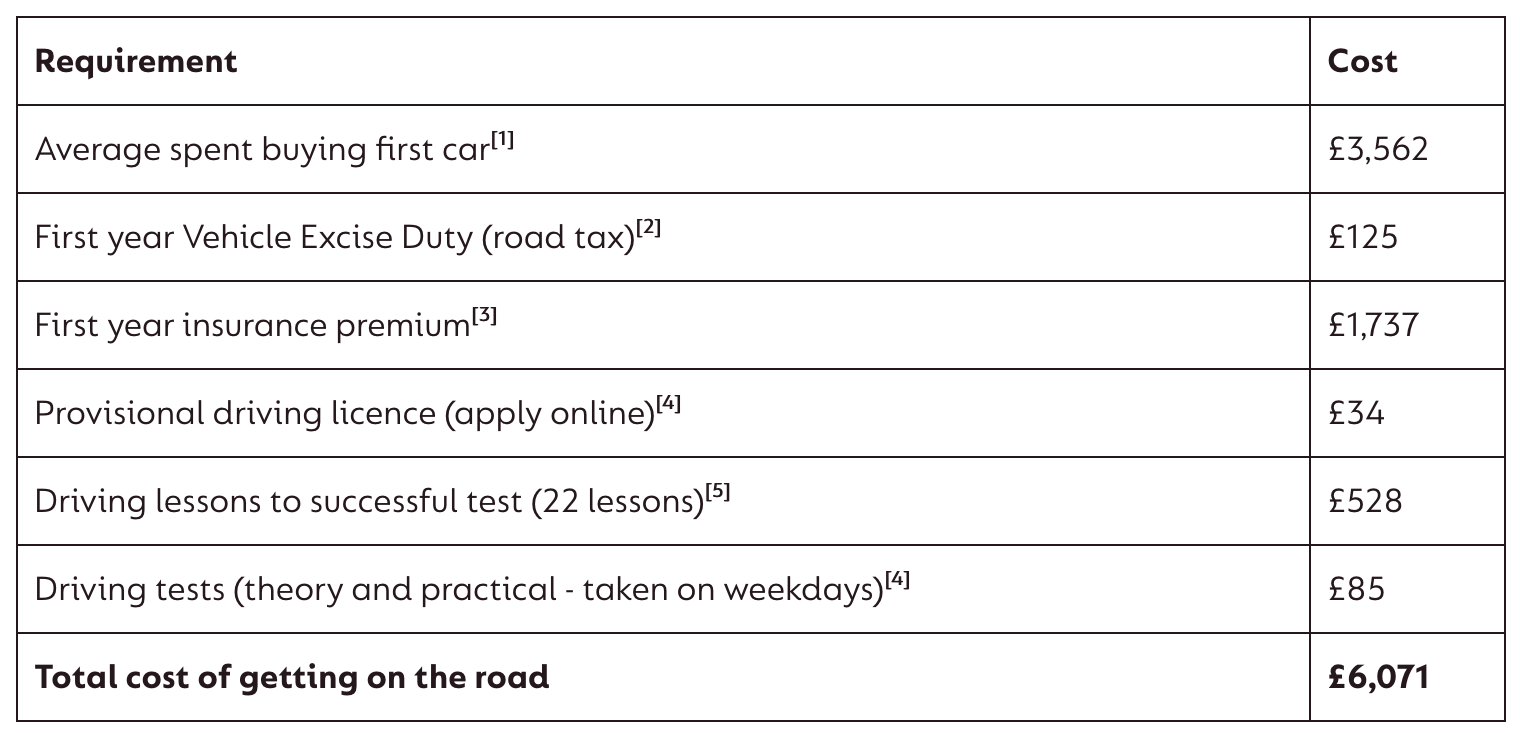

For many young people, passing their driving test and getting a car means the ability to travel, see friends and enjoy a new found freedom. However, they first need to get car insurance, something that is often seen as prohibitively expensive for new and young drivers.

Parents Breaking The Law – Fronting Penalties

To skirt around paying such high premiums, many mums and dads do what they think is helping out their teenage son or daughter, by naming themselves as the main driver of the car instead of their child. However, this is illegal.

The stated main driver on a car insurance policy must be the person who will be doing the majority of the driving. To dishonestly say otherwise is known as ‘fronting’ and is classed as insurance fraud.

The main driver is the person who:

- Drives the car the most often / the most miles

- Uses the car to commute to and from a place of work

- Keeps the car at their home

Fronting is a criminal offence and the penalties can be severe including:

- Your insurance company invalidating your policy

- Your insurance company recovering costs from you following an accident

- A court prosecution for insurance fraud resulting in a criminal record

- A large fine

- Six penalty points on your licence

Further downsides to consider

The consequences of fronting don’t just stop there. After being caught fronting, both the parent and young driver will find it very difficult to get cheap car insurance in the future and may even be left without having insurance at all.

Having a criminal record for insurance fraud may also hurt your ability to get credit as some systems used by loan companies, mortgage providers and credit card firms may flag up your name as a potential risk resulting in refusal of credit.

Young Driver Statistics

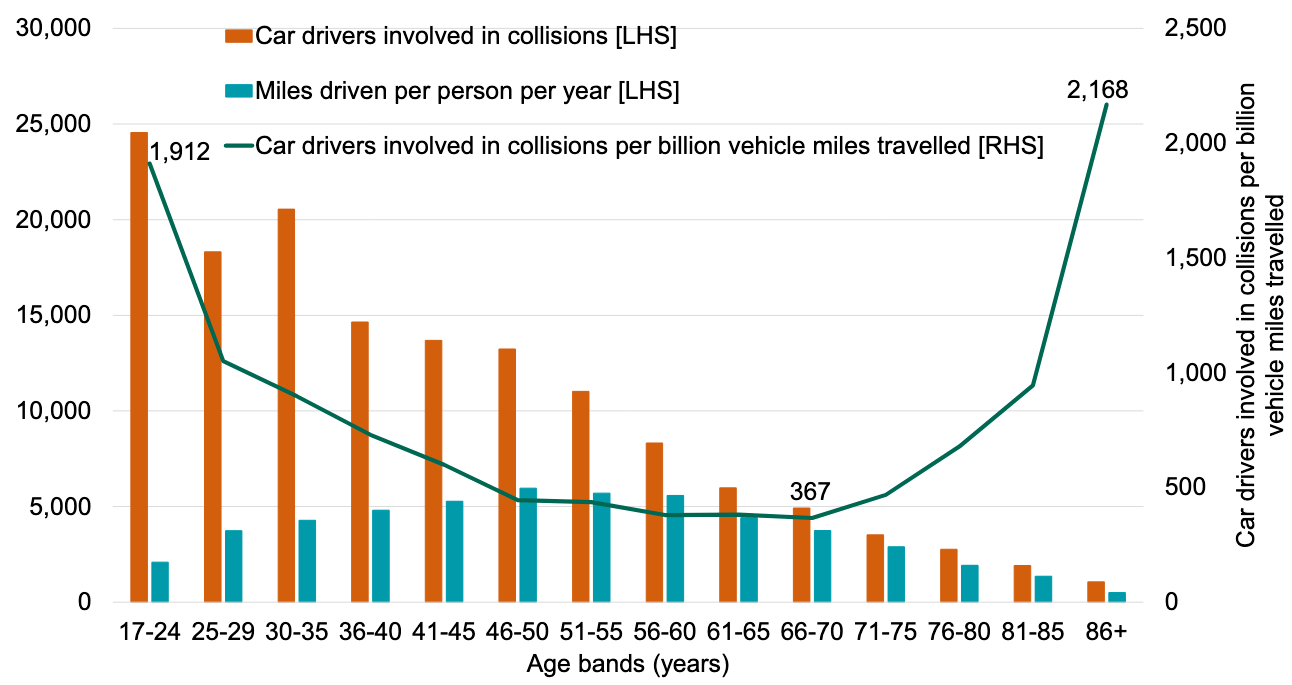

Insurance companies are extremely wary of taking on young drivers, and with good reason. According to the Department for Transport, young drivers have a higher casualty rate given distance travelled compared to all car drivers, with males accounting for 80% of all young driver fatalities. As a side note, more than four out of five young driver fatal casualties happen on rural roads.

Source: Department for Transport

Young Driver Insurance Claims

The Association of British Insurers (ABI), reports that drivers aged between 17-24 make up just 7% of all UK driving licence holders. However, despite this and the fact that they drive fewer miles (around 2,000 miles per year) than the average driver (around 4,100 miles per year), this young demographic is involved in 24% of all fatal collisions.

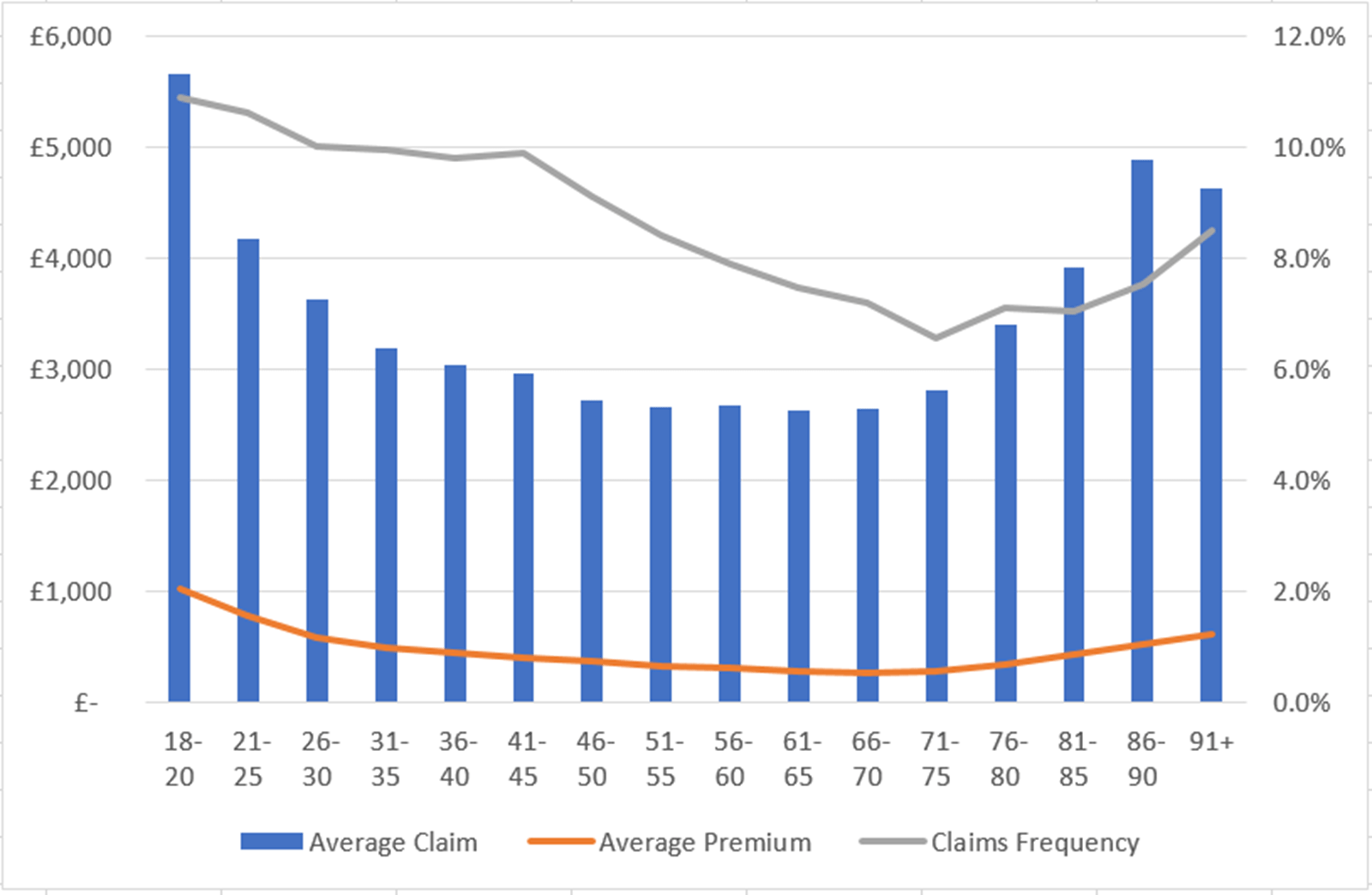

The average claims frequency (the percentage of policyholders that make a claim) is around 11% for drivers aged 18-20. This claims frequency drops as people get older to around 7% when the policyholder hits 70 years of age – it then starts to increase again.

Furthermore, the average cost of a claim for young drivers is around £5,500, compared to around half that for people over 30.

Source: Association of British Insurers (ABI)

Young Driver Insurance Costs

These shocking statistics for young drivers do not go unnoticed by insurance underwriters and a heavy weighting is applied to the main driver age resulting in significantly higher premiums.

According to a 2020 report by comparison site Go Compare, the average premium for a 17-year-old is around £1,700. This is despite the fact the car insurance costs for this age group have fallen by nearly 50% in the last decade.

Source: GoCompare

Young Drivers and Car Insurance Groups

The combination of being a young driver and owning a high insurance group rated car also increases the cost exponentially as the group rating gets higher. With over 30+ million cars on the road, insurers separate cars into one of 50 Insurance Groups. With Group 1 rated cars being the cheapest to insure and Group 50, the most expensive.

Insurance Group ratings are decided on multiple factors including:

- Engine size

- Maximum Speed

- Acceleration Speed

- Cost of Vehicle

- Security Features

- Safety Features

- Cost of Replacement Parts

In fact, a 17-year-old driver wanting to insure a very high group car will often find that many insurance companies won’t even offer a quote due to the risk profile being so dangerous. This is why it’s best for a young or new driver to opt for as low an insurance group rated car as possible – preferably a Group 1 car.

How can young drivers lower their car insurance?

There are a number of ways that young drivers can legally use to keep down insurance costs:

1. Adding mum and dad as named drivers

Whilst adding them as main drivers can be classed as fronting, adding one or both parents as named (additional) drivers is perfectly fine and legal. It also doesn’t have to be a parent. Adding any older and more experienced driver as a named driver can help reduce your cost

In fact, according to MoneySuperMarket, young people aged 17-24 can reduce their car insurance by 32% just by adding a name driver to the policy. Remember that a named driver is expected to drive the car.

2. Buying a low Insurance Group rated car

As mentioned earlier, new and young drivers will do well to choose a low insurance group car. Insurers will rate on a combination of your age and the insurance group of your car. So, try and buy a car with a Group 1 rating or as close as possible.

You should always get quotes on the car you’re thinking of BEFORE you purchase it. There are many cases of young people buying a high group car and then finding that either no company will insure them or the price is astronomical.

3. Avoiding performance or aesthetic modifications

Anything that increases the performance of a car such as an engine mod that results in higher speeds or improved acceleration, will inevitably result in higher premiums.

All modifications need to be declared to your insurer. This also includes anything that makes your car look more desirable such as a fancy spoiler. Such mods make it more likely that your car is stolen and underwriters will increase your price because of this.

4. Opting for a telematics (black box) insurance policy

Many young drivers are wary of such policies but statistically they can lower your insurance cost quite significantly.

They encourage you to drive better and safer resulting in less accidents and lower premiums going forward.

The one thing to look out for are the additional fees you may have to pay for going over your agreed mileage. Be certain to read the policy wording before purchasing – as you should with every insurance policy.

5. Completing an advanced driving test

An advanced test, such as Pass Plus or RoSPA, usually costs less than £200 but the benefits can last for a lifetime of driving. Some insurance companies even give you a discount for passing the test as you’re seen as a more conscientious and safer driver.

The real benefit though is that you improve your chances of avoiding having an accident and needing to claim on your insurance. Doing so means you build up your No Claims Bonus, which is by far the biggest rating factor that affects the price of car insurance.

6. Using a comparison website

With hundreds of insurance providers it’s almost impossible to get quotes by visiting each individual company. That’s where comparison sites work well, they can compare prices from across the insurance market just by you completing one online form.